Fall '24

AI-Budgeting

Increasing financial literacy and promoting healthy financial behaviors utilizing AI

Reimagining Budgeting Through Intelligent, Trusted AI

At-a-glance

Personal finance tools often struggle to balance simplicity with meaningful insight, especially when artificial intelligence feels gimmicky rather than helpful. In this UX exploration, we designed an AI-enabled budgeting app that supports users in understanding and managing their finances without overwhelming them. Through research, persona development, task flows, and prototype iterations, we focused on how contextual AI could deliver personalized guidance that feels reliable, transparent, and genuinely useful, helping users build better financial habits with clarity and confidence.

Industry

FSI & AI

Role

Research

Conceptualization

Design

Timeline

Fall 2024

5 months

Team

My Contributions

-

Accelerated design and research through AI integration

-

Led the end-to-end project as team lead, strategically integrating AI tools into our design, research, and documentation workflows. This significantly streamlined tasks like protocol writing, user testing analysis, and early ideation—cutting our timeline nearly in half while maintaining high quality.

-

-

Facilitated stakeholder alignment

-

Owned communication with client stakeholders, running feedback sessions and weekly syncs to ensure our solutions aligned with business priorities and delivered measurable value.

-

-

Mentored and supported team growth

-

Provided guidance and mentorship to team members throughout the project, helping them strengthen their research, ideation, and design skills. Created a collaborative environment where everyone could contribute confidently and grow in their roles.

-

Problem breakdown

How can we design engaging, personalized budgeting tools that address Gen Z college students’ lack of financial literacy and motivation to budget?

1.

2.

3.

Goals

Understand current financial habits, pain points, and motivations of Gen Z college students

Identify gaps in the financial literacy tools marke

Design an intuitive, integrated budgeting feature that encourages consistent use and healthier financial behaviors

What problem

did we solve?

-

Knowledge & motivation gap

-

Many college students lack budgeting knowledge and motivation, leading to impulsive spending and poor financial habits.

-

-

Tool engagement gap

-

While numerous financial tools exist, they often fail to engage this demographic, features are either too complex, scattered across multiple platforms, or lack personalization.

-

The Gen-Z population often struggles with financial literacy. Therefore, we seek to to identify users’ behaviors, habits, and knowledge regarding financial literacy, habits and struggles.

User Group

Who are we solving for and why?

Meet Sam!

Sam is a student at Purdue University and is studying computer science. She took out a loan to pay for her studies and thinks she should keep track of her finances.

Sam does not have a good understanding of financial literacy, she budgets by trying not to spend too much money each week. She knows that different tools exist but she simply doesn’t have any motivation to do so.

Current Experience

When our user group opens up their bank account to begin thinking about a budget, they are instantly presented with a variety of numbers and information. It is especially overwhelming for novice users such as Sam.

“I want something that does the stuff for me”

-User B interview

Goal features focus more on long-term goal setting rather than smaller, more actionable steps

-

Jargon languages that college students don't understand

Sam heard that she should be budgeting, but when she opened her bank account she felt

-

overwhelmed

-

confused

-

anxious

found through research activities

Milestone 1

Identifying relevant users and beginning to explore the user journey

Understand the attitudes and behaviors college students have towards personal financial literacy topics such as budgeting, taxes, spending, investing, etc.

Understand the knowledge gaps college students have towards financial literacy topics such as budgeting, taxes, spending, investing, etc.

Research

We researched Gen Z college students’ financial habits through literature reviews, competitive analysis, and interviews, uncovering low financial literacy, limited motivation to budget, and emotional triggers driving impulsive spending. These insights shaped our personas and guided our design focus.

Literature Review

Summarized 10+ research reports; findings revealed low financial knowledge, impulsive spending habits, and limited use of existing tools.

User Interviews

“I know I should be budgeting and investing, but I don’t know what to invest, or how to even do it. Is there like a website or something?”

Persona Development

Created persona which represents common financial literacy levels and motivations. These guided design priorities by highlighting distinct needs in budgeting support and tool engagement.

Milestone 2

Uncovering what's missing from today's financial tools

Identify Common Problems and Pain Points in Financial Literacy Tools

Identify where we can implement solutions

Begin Ideation, Lo-Fi Designs, and Testing

Different Directions

Research showed that our user group, such as Sam, had a particular interest in investing, which was the initial design idea for our solution. However, we interviewed experts in the field which caused us to pivot.

“Investing is important—but students need a strong foundation first. Without a budget, they’re not ready.”

It became clear that since Sam was financially illiterate, they were not prioritizing budgeting. We decided to focus on enabling Sam to become more confident with budgeting, which would then allow her to eventually begin investing.

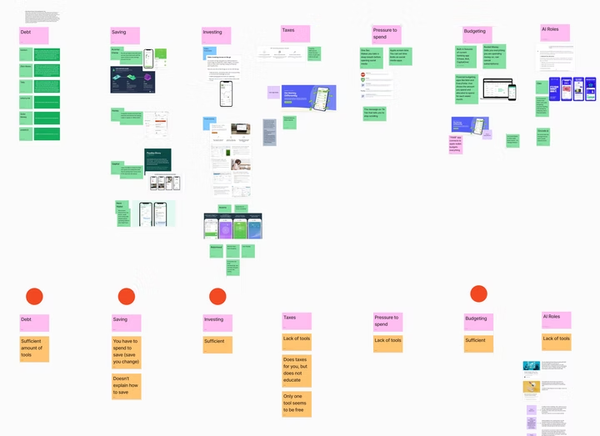

Competitive Analysis

A competitive analysis was conducted to discover existing gaps in the market for financial budgeting, such as Rocket Money, Acorns, etc.

Key Insights

-

Majority of tools did not integrate into day-to-day lives

-

Features such as long-term planning were ignored

-

Tools made user feel bad about themselves, were overly complicated, and not engaging

-

Lack of personalization and motivation

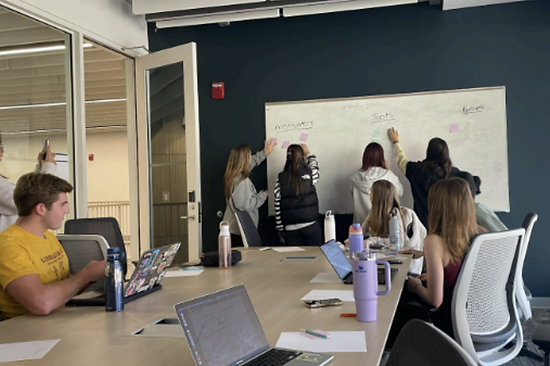

Discovery Workshop

Understand our user groups behaviors, attitudes, and motivations towards budgeting

-

Lack of knowledge and understanding of budgeting

-

Do not feel motivated to budget, but feel like it could be important

-

Could be motivated by external forces like monetary incentives, but are unsure.

“I just try not to spend money. Like if I want to go out with my friends on Saturday, I try not to buy anything during the week. It makes me sad looking at my bank account.”

-Participant

Co-Design Workshop

Collaboratively explore user motivations, challenges, and ideas related to budgeting and financial management

-

Beneficial if features were within their current bank app

-

Would like the features to be straight forward, easy to use without requiring a lot of knowledge or calculations

“I get way too much anxiety trying to sift through my own account and make a budget”

-Participant

Barriers

Different expenses each month

Takes too long, too much math

Stressful to do by yourself

College life/too busy

Tools

Notification when near budget

Built-in calculator

Appears on phone without opening app

Needs to do it for me

Motivators

Minimize debt

Save money to spend on important items

Being able to hang out with friends

Financial security

Above, you will see the responses that were collected during the co-design workshop that answer the question of what prevents them from budgeting, what tools they would find useful, and what would motivate them to budget.

Next steps

-

From our interviews and co-design, we learned that Sam does not want to download another app

-

There are already so many different apps available, they are not be utilized for a reason

-

-

Sam has no motivation, she just wants to see what she needs to do

-

Everyone e in the co-design stated that they would want this tool within their bank app

Milestone 3

What is an applicable way to transform our insights into actionalbe designs? How do we integrate trust?

Create Mid-Fidelity Designs

Test and iterate

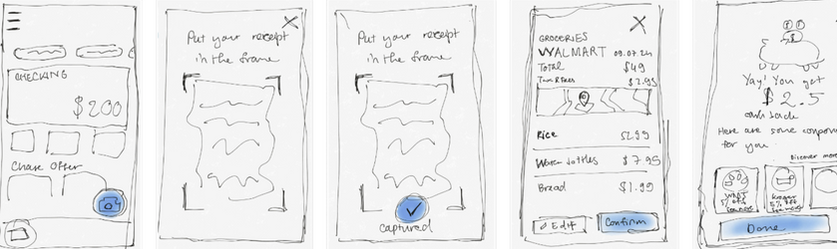

Ideation

During the co-design, participants were asked to draw a tool that would be most used by themselves. From these sketches, we were able to brainstorm and iterate using our previous insights, we ended with 2 main ideas.

Receipt Scanner + Cashback

(existing apps on market)

Ai budgeting assistant integrated into existing banking app

Different Directions

Concept testing was conducted to determine which tool would be most effective

Receipt Scanner

-

Like receiving cash back and easy to understand

-

However, users hardly save receipts and would be easy to forget to use

Ai assistant

-

Visuals of spending habits determined to be useful, and optional for manual budgeting or AI

-

However, lack of trust with AI

The AI solution was selected in the end based on user feedback, but more importantly, it had stronger rationale from our research, workshops, and competitive analysis.

There are already apps with receipt scanning that most people tend to download and then forget about. The AI solution would be able to automatically create a personalized budget within minutes, reducing many obstacles that our user group faces in creating a budget.

Testing and Final Design

A prototype was created and then concept tested with users to determine how effective it was portrayed as. Initial reactions were positive, participants stating they appreciated how straight forward it was and saw potential.

However, we also discovered unexpected pain points. Certain aspects were causing confusion and others lacked a sense of trust with allowing AI to access bank information.

This feedback prompted a strategic pause to re-evaluate how to make the tool feel clearer, more approachable, and genuinely supportive.

Reflection

How does our solution solve the initial problems we identified?